KPresentation2001_ing

Transcript of KPresentation2001_ing

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 1/29

1.

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 2/29

2.

✔ Corporate Structure

✔ Business Segments

✔ Company Overview

✔ Financial Highlights

Agenda

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 3/29

3.

Corporate Structure

K labin S. A.

KlabinBacell

KlabinArgentina

NorskeSkogKlabin

KlabinKimberly

KCKTissue

100% 50%82% 50%50%

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 4/29

4.

Shareholder Structure12/31/01

Klabin Irmãos 59.5%

Monteiro

Aranha 20.0%

Brazilian Investors

20.5%

Com m on Prefer red

BNDESPAR

31.6%

Institutional Investors

10.9%

Foreign Investors

18.5%

Brazilian Investors 39.0%

Common 317,049,392

Preferred 601,750,949

Total 918,800,341

Local Share Price (Klbn4)

Book Value

Free FloatDaily Traded Volume

R$ 0.98

R$ 1.44

66%R$ 587,000

Shares Outstanding 600,856 K

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 5/29

5.

Business Segments

( ) Joint venture to be terminated on March, 2003

Klabin

Forestry TissuePulp PaperCorrugated

BoxesSacks Newsprint

(*)

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 6/29

6.

28 Industrial Sites

PE

BA

MG

RJSP

RSSC

PR

Argentina

Forestry

Rio Grande do SulSanta CatarinaParanáSão Paulo

Bahia

PulpCamaçariGuaíba

- RS- SC- PR- SP

- BA

- BA- RS

Monte AlegreAngatubaOtacílio CostaCorreia PintoGuaíba

Paper

- PR- SP- SC- SC- RS

NewsprintMonte Alegre - PR

TissueBrazil Santo AmaroMogi das CruzesCruzeiro

Correira Pinto

Argentina Bernal

- BA- SP- SP

- SC

Broad Geographic Coverage

Corrugated Boxes

GoianaFeira de SantanaBetimDel CastilhoGuapimirimJundiaí (2)ItaquaquecetubaPiracicabaItajaí

São LeopoldoPonte Nova

- PE- BA- MG- RJ- RJ- SP- SP- SP- SC

- RS- MG

Multiwall Bags

Brazil Correia PintoLages (2)

Argentina Pilar

- SC- SC

Packaging

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 7/297.

Forestry Assets

Productivity(m3/ha/year)

PinusEucalyptus

Actual

Best

3050

Average

3870

CompanyLands000 ha

PlantedForests000 ha

AverageDistance

Km

12/31/01 Position

Company Lands

Planted Forests

Native Preserved Forests

Others

426

237

130

59

000 ha

Paraná

Santa Catarina

Rio Grande do Sul

230

118

55

123

72

40

426 237

32

83

60

Bahia 19

São Paulo 4 2 108

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 8/298.

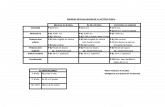

Brazilian Largest Pulp and Paper ProducersThousand tons

Source: Bracelpa 2001 preliminary

Production Share Production Share

1 K lab in 1,516 21% 1 K labin 1,440 19%

2 Suzano 736 10% 2 Aracruz 1,272 17%

3 IP 578 8% 3 Suzano 996 13%

4 Votorantim 555 8% 4 Votorantim 801 11%

5 Ripasa 410 6% 5 Cenibra 792 11%

6 Rigesa 290 4% 6 IP 417 6%

7 Orsa 252 3% 7 Jarcel 326 4%

8 Trombini 189 3% 8 Ripasa 303 4%

9 Pisa 166 2% 9 Rigesa 201 3%

10 Others 2,662 35% 10 Others 975 12%

Total 7,354 100% Total 7,522 100%

Paper Pulp

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 9/299.

Klabin45%

Portela

16%

Trombini

13%

Cocelpa/

Conpel

14%

Iguaçu

12%

Market Leadership

Corrugated Boxes (1)Klabin

29%

Trombini

8%Orsa

8%

Penha

6%

Rigesa

12%

Others

38%

Packaging Papers (2)

Orsa

7%Rigesa

15%Trombini

4%

Klabin

36%Others

38%

Multiwall Bags (3) Tissue (2)Klabin21%

Manikraft6%

Others46%

Melhoramentos10%

Santher17%

Source: (1) ABPO 2001

(2) BRACELPA 2000

(3) KLABIN 2001

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 10/29

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 11/2911.

Production and Converting CapacitiesThousand ton/year

Pulp Paper CorrugatedBoxes

Tissue Multiwall Bagsand Envelopes

155180

690

Dissolving

Softwood

Hardwood

1,000

115

555 1,530

1,6701,690

40 Printing/Writing

Packaging

Newsprint120

Capacity to sell over 2 million tons/ year of products

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 12/2912.

Sales - 1,000 ton

1998 1999 2000 2001

Publication Paper 157 137 151 124

Packaging Paper 248 289 352 549

Tissue 141 133 144 138

Pulp 370 378 335 340

Guaíba (RS) 265 274 236 236

Camaçari (BA) 105 104 99 104

Corrugated Boxes 282 307 373 510

Bags/Envelopes 99 101 108 116

Others 19 11 12 7

Tot al 1,316 1,355 1,474 1,784

Average Price - R$/ton 925 1,195 1,380 1,339

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 13/2913.

Sales - 1,000 ton

1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01

Publication Paper 38 36 38 38 30 25 32 37

Packaging Paper 74 62 81 136 135 135 120 159

Tissue 34 37 38 35 30 34 36 38

Pulp 72 92 87 83 70 94 95 81

Guaíba (RS) 56 64 67 49 49 69 66 52

Camaçari (BA) 16 28 20 34 21 25 29 29

Corrugated Boxes 72 76 89 135 128 132 124 126

Bags/Envelopes 26 27 28 27 30 31 27 28

Others 3 4 3 3 2 2 3 0

Total 319 334 364 457 425 453 437 469

Average Price - R$/ton 1,333 1,400 1,447 1,344 1,327 1,283 1,395 1,351

2000 2001

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 14/2914.

Sales - 2001Consolidated 100%

CorrugatedBoxes28%

Pulp

19%

PackagingPaper31%

Tissue8%

Publication

Paper7% Bags/Envelopes

7%

Volume

Volume

1,783,832 t onsPack aging - 66%

Net Revenue

R$ 2,585 m i l l ionPack aging - 56%

Net Revenue

Tissue17%

CorrugatedBoxes24%

PackagingPaper24%

Pulp15%

PublicationPaper

7% Others5%

Bags/Envelopes

8%

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 15/2915.

Net RevenueConsolidated

314

337

387

444

408433

472

572

536

567 (*)588

676

200

300

400

500

600

700

800

1Q99 2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01

R$ Million

C.A.G.R. = 32%

(*) Excluding the effect of the forestry sale of Klabin Riocell in 2Q01

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 16/29

16.

Sales by Market - 2001Consolidated 100%

Volume

Exports

38% DomesticMarket

62%

✔ Exports

Pulp

686

306

1,000 t on

To ta l

✔ Domestic Market

1,784

1,098

Kraftliner

Others

325

55

Net Revenue

Exports

32% DomesticMarket

68%

R$ Mi l l ion

Tot a l 2 ,585

✔ Domestic Market 1,752

✔ Exports

Pulp 338

833

Kraftliner

Others

322

173

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 17/29

17.

ExportsConsolidated

0

30

60

90

120

1Q99 2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01

US$ Million

60

69

8684

64

77

66

101

8883

C.A.G.R. = 18%

91 95

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 18/29

18.

Exports by Region - 2001Consolidated

Europe

46%

NorthAmerica

3%Latin America

24%

Asia

27%

Volume

Asia21%

Europe46%

Latin America

30%

NorthAmerica

3%

Net Revenue

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 19/29

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 20/29

20.

Financial HighlightsConsolidated

(2) Including non recurring items in EBITDA of R$ 41 million in 4Q01

(1) Excluding the effect of the forestry sale of Klabin Riocell in 2Q01

R$ Million 2000

Total 1Q01 2Q01 (1) 3Q01 4Q01 (2) Total

EBITDA 631 178 183 205 163 729

EBITDA Margin 33% 33% 32% 35% 24% 31%

EBIT 462 122 124 137 94 477

EBIT Margin 25% 23% 22% 23% 14% 20%

Total Assets 4,357 4,422 4,521 4,357 4,443 4,443 Net Debt 2,475 2,369 2,408 2,595 2,458 2,458

Equity 1,228 1,428 1,425 1,316 1,322 1,322

Minority Interest 59 59 60 62 62 62

Total Capitalization 3,762 3,856 3,894 3,972 3,842 3,842

Net Debt / Capitalization 66% 61% 62% 65% 64% 64%

2001 Pro Forma

C h G i

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 21/29

21.

EBITDAR$ Million EBITDAMargin

17

Cash GenerationConsolidated

97 106 115 138144 145

164178 178

205183(*)

122

3132

3031

3533

3531 33 32 35

31

0

50

100

150

200

250

1Q99 2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q010%

10%

20%

30%

40%

50%

41

163

(*) Excluding the effect of the forestry sale of Klabin Riocell in 2Q01

Including non recurring items of R$ 41 million in EBITDA in 4Q01

N D b / EBITDA (*)

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 22/29

22.

Net Debt / EBITDA (*)Consolidated

(*) Annualized

0

1

2

3

4

1Q99 2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01

3.3 x

3.0 x3.2 x

3.0 x

2.3 x2.4 x

2.3 x

3.3 x3.3 x

x = Times

3.3 x 3.4 x 3.4 x

(1) Excluding non recurring items of R$ 41 million in EBITDA in 4Q01

G D bt 12/31/01

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 23/29

23.

Gross Debt 12/31/01Consolidated

R$ Million

Gross Debt as of 12/31/00 2,627

Foreign Exchange Losses 359

New Funding 838

Amortization (460)(1,298)

Gross Debt as of 12/31/01 2,526

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 24/29

M t it S h d l

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 25/29

25.

128

40

127

37 274

32

471

33

400

136

297

226

74

263

0

100

200

300

400

500

600

1Q02 2Q02 3Q02 4Q02 2003 2004 2005

onwards

Local Currency (30%) Foreign Currency (70%)

R$ 2,586 Million / Average Term: 26 monthsR$ Million 45% 55%

156 164

337

536

306

504 523

Maturity ScheduleConsolidated - 12/31/01

Debt Maturity Schedule Foreign Currency

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 26/29

26.

Debt Maturity Schedule - Foreign CurrencyConsolidated - 12/31/01

US$ Miillion

19

2950

4

89

29

87

109

6

114

58

74

23

31

25

7

0

50

100

150

200

1Q02 2Q02 3Q02 4Q02 2003 2004 2005

onwards

2

Trade Finance Bonds Others

50

172

32

118128

203

55

Total US$ 758 Million Average Term: 20 months Average Cost: 8.6% per year

Debt Maturity Schedule Local Currency

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 27/29

27.

R$ Million

373

313

311

321

134

2

108

115

4

261

2

0

50

100

150

200

250

1Q02 2Q02 3Q02 4Q02 2003 2004 2005

onwards

BNDES Debentures Others

Total R$ 767 Million Average Term: 38 months Average Cost: 16.7% per year 263

227

136

40 36 32 33

Debt Maturity Schedule - Local CurrencyConsolidated - 12/31/01

2

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 28/29

8/6/2019 KPresentation2001_ing

http://slidepdf.com/reader/full/kpresentation2001ing 29/29

29.

Additional Information

Investor Relations

Tel.: 55 11 3225-4045 / 4046

Fax.: 55 11 [email protected]

www.klabin.com.br